TORONTO, Nov. 20, 2024 (GLOBE NEWSWIRE) — Apolo IV Acquisition Corp. (TSXV: AIV.P) (“Apolo”) and Marviken Ontario Inc. (“Marviken”) in cooperation with BotOptions (UK) PLC, a financial institution specialising in the issuing of debt instruments, are pleased to announce that, further to its news release dated October 22, 2024, it has entered into a definitive merger agreement dated November 19, 2024 (the “Merger Agreement”) with Marviken, Marviken ONE AB (“Marviken Sweden”) and Apolo IV Amalco Inc. (“Apolo Subco”), a wholly-owned subsidiary of Apolo, in connection with the proposed business combination of Apolo Subco and Marviken, which transaction (the “Proposed Transaction”) is intended to constitute Apolo’s “Qualifying Transaction” (within the meaning of Policy 2.4 – Capital Pool Companies of the TSX Venture Exchange (the “Exchange”)).

The Proposed Transaction is structured such that Apolo Subco will amalgamate with Marviken (the “Amalgamation”) under the Business Corporations Act (Ontario) (“OBCA”) to form a newly amalgamated company (“Amalco”). Pursuant to the Amalgamation, holders of common shares in the capital of Marviken (each a “Marviken Share”) will receive one common share in the capital of Apolo (each, an “Apolo Share”), in each case on a post-Consolidation (as defined below) basis. In addition, pursuant to the Amalgamation, each Marviken stock option and certain Marviken warrants will be exchanged for an Apolo stock option and/or Apolo warrant, as applicable, on substantially the same terms and conditions, except that such securities will thereafter be exercisable to receive common shares of the entity resulting from the Proposed Transaction (the “Resulting Issuer”).

In order to align the value of the Apolo Shares with the value per Marviken Share at which the Proposed Transaction and the Concurrent Financing (as defined below) will be completed, Apolo will consolidate the Apolo Shares on the basis of one post-consolidation Apolo Share for every 4.1667 existing Apolo Shares as of the date of this news release (the “Consolidation”).

Upon completion of the Proposed Transaction, the Resulting Issuer will carry on the business of Marviken and Marviken Sweden. Pursuant to the terms of the Proposed Transaction, Apolo intends to change its name to “Marviken Energy Inc.” or such other name as is mutually agreed between Apolo and Marviken and acceptable to applicable regulators (the “Name Change”). Further, it is proposed that the officers and directors of Marviken will replace the existing officers and directors of Apolo.

The Proposed Transaction is subject to a number of other conditions, including obtaining all necessary board, shareholder and regulatory approvals, including Exchange approval.

The Merger Agreement

The Merger Agreement contemplates that, among others, the following conditions precedent be met prior to the closing of the Proposed Transaction (the “Effective Date”), including, but not limited to, (a) acceptance by the Exchange and receipt of other applicable regulatory approvals; (b) completion of the Subscription Receipt Financing (as defined below); (c) receipt of the requisite approvals of the shareholders of Apolo (the “Apolo Shareholders”) with respect to the Apolo Consolidation, adoption of a new stock option plan (in such form as requested by Marviken, acting reasonably) (the “Stock Option Plan”), the director appointments agreed upon by Apolo and Marviken (the “Director Appointments”) and adoption of an advance notice by-law; (d) receipt of the requisite approvals of the shareholders of Marviken with respect to the Amalgamation; (e) no adverse material change in the business, affairs, financial condition or operations of Marviken or Apolo having occurred between the date of entering into the Merger Agreement and the closing date of the Proposed Transaction; and (f) dissent rights shall have been exercised in respect of no more than 5% of the issued and outstanding Marviken Shares. There can be no assurance that the Proposed Transaction will be completed as proposed or at all.

The Amalgamation will not constitute a Non-Arm’s Length Qualifying Transaction (as such term is defined in the policies of the Exchange). No person who or which is a Non-Arm’s Length Party (as such term is defined in the policies of the Exchange) of Apolo has any direct or indirect beneficial interest in the share capital of Marviken or its assets prior to giving effect to the Amalgamation and no such person is an insider of Marviken. Similarly, there is no known relationship between or among any person who or which is a Non-Arm’s Length Party of Apolo and any person who or which is a Non-Arm’s Length Party to Marviken.

If all conditions to the implementation of the Amalgamation have been satisfied or waived, Apolo and Marviken will carry out the Amalgamation. Pursuant to the terms of the Amalgamation, it is expected that the following security conversions, exercises and issuances will occur among Apolo, Marviken and the securityholders of Marviken at or prior to the Effective Date:

- the Apolo Shares being consolidated on the basis of one (1) post-Apolo Consolidation Apolo Share for every 4.1667 pre-Apolo Consolidation Apolo Shares;

- the Subscription Receipts being exchanged, without additional consideration or further action, into Marviken Consolidation Shares upon satisfaction of the Escrow Release Conditions;

- each broker warrant (as defined below) to be issued to the Agents (as defined below) in connection with the Concurrent Financing outstanding immediately prior to the Effective Date shall be exchanged for Resulting Issuer Share purchase warrants (the “Resulting Issuer Broker Warrants”) such that the holders of such Resulting Issuer Broker Warrants will be entitled to the purchase of one Resulting Issuer Share per one Resulting Issuer Broker Warrant;

- Apolo will acquire all of the issued and outstanding Marviken Shares such that all issued and outstanding Marviken Shares, including those issued in exchange for the Subscription Receipts, will be exchanged, without additional consideration or further action, for Resulting Issuer Shares on the basis of one (1) Marviken Share for one (1) Resulting Issuer Share;

- each stock option of Marviken and each warrant of Marviken outstanding immediately prior to the Effective Date, whether vested or not vested, shall be cancelled and exchanged for comparable securities of the Resulting Issuer (“Resulting Issuer Options” and “Resulting Issuer Warrants”) on economically equivalent terms, subject to adjustments contemplated by the Merger Agreement; and

- each stock option of Apolo outstanding immediately prior to the Effective Date, whether vested or not vested, shall be cancelled and exchanged for Resulting Issuer Options on economically equivalent terms, subject to adjustments contemplated by the Merger Agreement.

Capitalization

As at the date of this news release and prior to the Consolidation, Apolo has 20,000,000 common shares and 2,750,000 stock options, each exercisable to acquire one Apolo Share (on a pre-Consolidation basis), issued and outstanding. As at the date hereof, Marviken has 50,000,000 common shares issued or issuable under existing agreements.

On completion of the Proposed Transaction, assuming the completion of a $5,000,000 subscription receipt private placement financing by Marviken (the “Concurrent Financing”) through a syndicate of agents led by Haywood Securities Inc. (the “Agents”) as further described in Apolo’s news release dated October 22, 2024, and assuming completion of the Consolidation, it is anticipated that there will be an aggregate of approximately 64,800,000 Apolo Shares outstanding, of which 7.4% shall be held by the former Apolo shareholders, and the remainder by the Marviken shareholders, including subscribers under the Concurrent Financing. The foregoing excludes any Apolo shares issuable under any convertible instruments (including under any Resulting Issuer Options, Resulting Issuer Options or Resulting Issuer Broker Warrants).

Sponsorship

The Proposed Transaction is subject to the sponsorship requirements of the Exchange, unless a waiver or exemption from this requirement can be obtained in accordance with the policies of the Exchange. In connection with the Concurrent Financing, Apolo intends to apply for a waiver of the sponsorship requirement; however, there is no assurance that a waiver from this requirement can or will be obtained.

Trading in Apolo Shares

Trading in the Apolo Shares will remain halted pending the review of the Proposed Transaction by the Exchange and satisfaction of the conditions of the Exchange for resumption of trading. It is likely that trading in the Apolo Shares will not resume prior to the closing of the Proposed Transaction.

This news release does not constitute an offer of securities for sale in the United States. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States absent U.S. registration or an applicable exemption from U.S. registration requirements.

A subsequent news release with respect to the closing of the Concurrent Financing and an update on the status of the Proposed Transaction will follow in due course.

A filing statement of Apolo will be prepared and filed in accordance with the policies of the Exchange.

Marviken is represented by Mason Law. Cassels Brock & Blackwell LLP acts as legal counsel to Apolo. Bennett Jones LLP acts as legal counsel to Haywood Securities Inc.

About Apolo

Apolo was incorporated under the OBCA and is a capital pool company within the meaning of the policies of the Exchange. Apolo has not commenced operations and has no assets other than cash. Apolo’s principal business is the identification and evaluation of assets or businesses with a view to completing a “Qualifying Transaction” under Exchange Policy 2.4 – Capital Pool Companies.

About Marviken

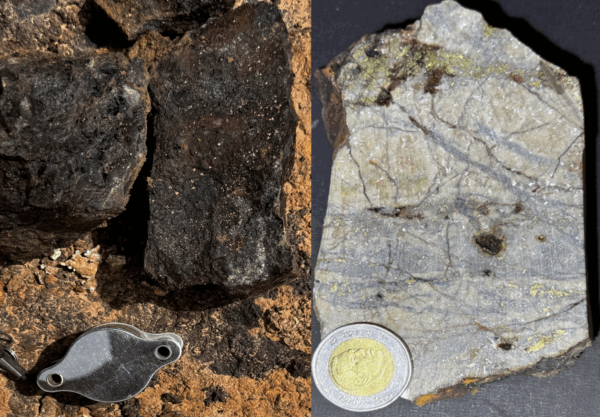

Marviken is the owner of a 600 acre site (the “Energy Cluster”) that is strategically located south of Stockholm, Sweden. The Energy Cluster benefits from a long history of power production, existing operational battery facilities, and plans for significant expansion, including a data center and a 70 MW / 70 MWh battery energy storage system (“BESS”) (collectively, the “Project”) connecting via an on-site substation. Marviken is aiming to build services in the transformation of the Swedish energy landscape, driven by a significant need to address grid reliability.

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains statements which constitute “forward-looking information” within the meaning of applicable securities laws, including statements regarding the plans, intentions, beliefs and current expectations of Apolo and Marviken with respect to future business activities and operating performance. Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions and includes information regarding: (i) expectations regarding whether the Proposed Transaction will be consummated, including whether conditions to the consummation of the Proposed Transaction will be satisfied, or the timing for completing the Proposed Transaction; (ii) the timing for closing and the pricing and size of the Concurrent Financing; and (iii) expectations for other economic, business, and/or competitive factors.

Investors are cautioned that forward-looking information is not based on historical facts but instead reflect Apolo and Marviken’s respective management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although Apolo and Marviken believe that the expectations reflected in such forward-looking information are reasonable, such information involves risks and uncertainties, and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of the combined company. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information are the following: the ability to consummate the Proposed Transaction; the ability to obtain requisite regulatory and shareholder approvals and the satisfaction of other conditions to the consummation of the Proposed Transaction on the proposed terms and schedule; the potential impact of the announcement or consummation of the Proposed Transaction on relationships, including with regulatory bodies, employees, suppliers, customers and competitors; changes in general economic, business and political conditions, including changes in the financial markets; and the diversion of management time on the Proposed Transaction. This forward-looking information may be affected by risks and uncertainties in the business of Apolo and Marviken and market conditions.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Apolo and Marviken have attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. Apolo and Marviken do not intend, and do not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

For further information, please contact:

Timothy Holmes, Director

E-mail: [email protected]

Apolo IV Acquisition Corp.

Sean Maniaci

E-mail: [email protected]

Completion of the Proposed Transaction is subject to a number of conditions, including but not limited to Exchange acceptance and, if applicable pursuant to Exchange requirements, majority of the minority shareholder approval. Where applicable, the Proposed Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Proposed Transaction will be completed as proposed or at all.