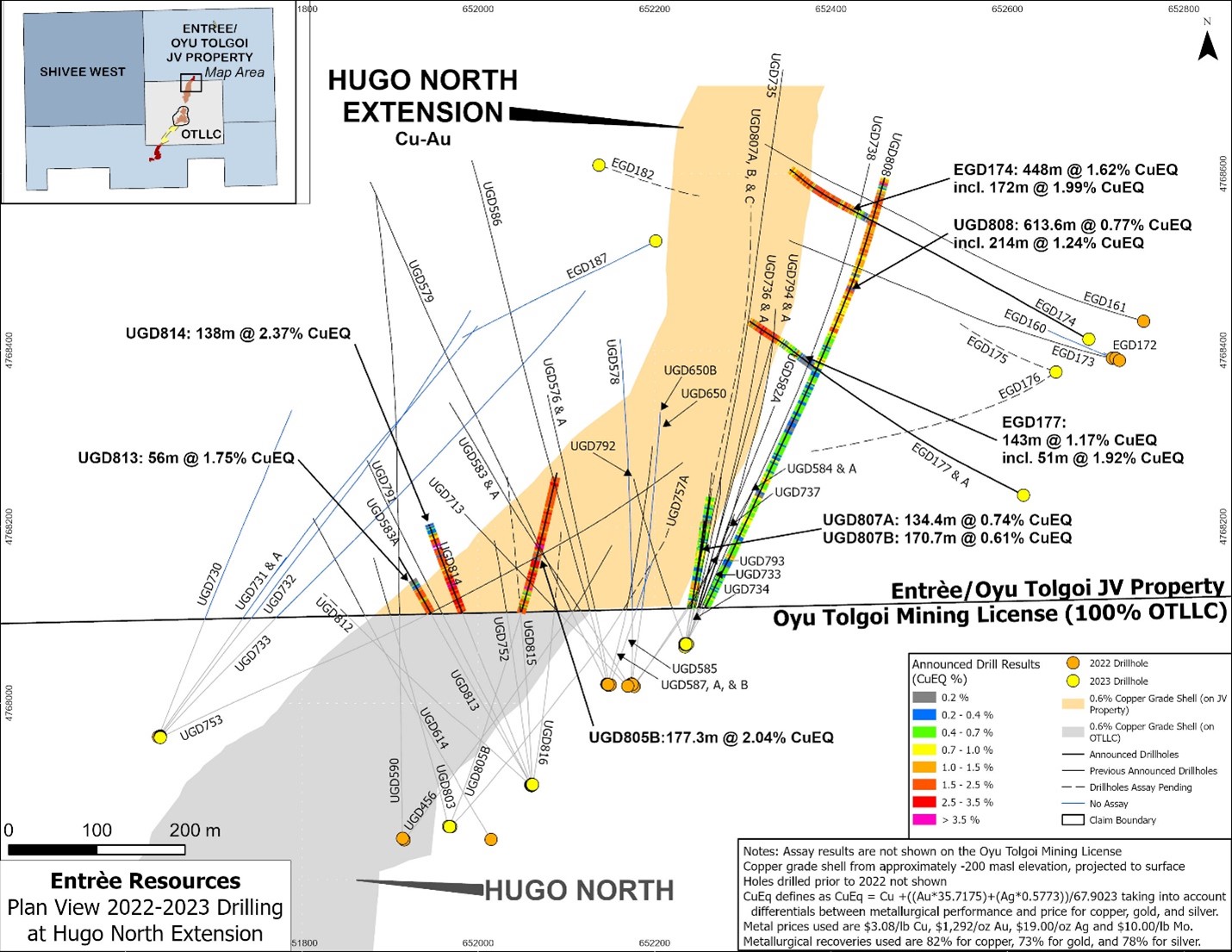

VANCOUVER, British Columbia, Nov. 04, 2024 (GLOBE NEWSWIRE) — Entrée Resources Ltd. (TSX:ETG; OTCQB:ERLFF – the “Company” or “Entrée”) is pleased to provide analytical results for eight diamond drill holes (“DDH”) from the 2023 drilling program over the Hugo North Extension (“HNE”) deposit on the Entrée/Oyu Tolgoi JV Property (the “Entrée/Oyu Tolgoi JV Property”) in Mongolia (refer to Figure 1). Analytical results for 14 holes were previously announced on July 18, 2024. Results for eight remaining holes from the 2023 program, as well as all surface and underground holes from the ongoing 2024 drilling program, will be reported as they become available from the Company’s joint venture partner Oyu Tolgoi LLC (“OTLLC”).

2023 DRILL HOLE HIGHLIGHTS

HNE Surface Drill Holes

- EGD 174: 448 metres (“m”) grading 1.62% copper equivalent1 (“CuEq”), including 172 m grading 1.99% CuEq.

- EGD 1772: 143 m grading 1.17% CuEq, including 51 m grading 1.92% CuEq.

HNE Underground Drill Holes

- UGD 805B: 177.3 m grading 2.04% CuEq.

- UGD 808: 613.6 m grading 0.77% CuEq, including, 214 m grading 1.24% CuEq.

- UGD 813: 56 m grading 1.75% CuEq.

- UGD 814: 138 m grading 2.37% CuEq.

- Copper equivalent is defined below in Table 2, where full details on the drill hole assay intervals are also found.

- EGD177 is the upper portion of “daughter” drill hole EGD177A, which was previously reported on July 18, 2024.

Stephen Scott, Entrée’s President and CEO said, “I suspect none of our shareholders will be surprised by these outstanding additional drill results, which are entirely consistent with results disclosed by the Company earlier this year. From what we are seeing Hugo North, including the Hugo North Extension deposit on the JV Property, continues to demonstrate the potential to be one of the best copper-gold deposits discovered in the last 50 years. I look forward to seeing all drill results incorporated into an updated resource model for Hugo North Extension Lifts 1 and 2.”

2023 HNE DRILLING RESULTS

The new results from the 2023 HNE drilling program include two surface holes that were drilled entirely on the Entrée/Oyu Tolgoi JV Property and six underground holes that were collared from existing infrastructure on the Oyu Tolgoi mining licence and drilled onto the Entrée/Oyu Tolgoi JV Property. OTLLC previously advised the Company 33 drill holes were completed at HNE in 2023. The results from 14 of those holes were reported by the Company on July 18, 2024, three holes were drilled outside of the mineralized footprint for geotechnical purposes and therefore not assayed, results from eight holes were recently made available by OTLLC and are reported below, and the remaining eight holes are still pending analytical results. Full collar and downhole survey details for each of the holes in the 2023 HNE drilling program were provided by the Company on July 18, 2024 (refer to press release dated July 18, 2024 titled, “Entrée Resources Announces Additional Drill Results and Provides an Update on Underground Development Work” available on SEDAR+ at www.sedarplus.ca).

The new drilling results include two surface holes, EGD174 and EDG177, the latter of which is the upper portion of “daughter hole” EDG177A (previously reported on July 18, 2024). Both holes were drilled steeply towards the northwest and crossed through approximately 1,350 to 1,400 m of barren, sedimentary and volcanic tuff units before intersecting the top of porphyry deposit. Starting at 1,352 m, drill hole EGD174 entered a 448 m interval of significant copper and gold mineralization, averaging 1.62% CuEq that includes 258 m within the footprint of the potential Lift 2 block cave, followed by an additional 190 m below the base of the footprint. The hole was eventually terminated at a depth of 1,800 m in strong copper-gold mineralization, which remains open at depth, and which the Company believes provides continuity for deeper, potential future lifts.

Significant mineralized intervals from the eight holes recently made available by OTLLC are summarized in Tables 1 and 2 and are shown on Figure 1.

Table 1: Surface Drill Results from 2023 Drilling at HNE Deposit1

| Drill Hole | From (m) | To (m) | Length2(m) | Gold (ppm) | Copper (%) | Silver (ppm) | CuEq3(%) | |

| EGD174 | 1352 | 1800 | 448 | 0.520 | 1.31 | 3.60 | 1.62 | |

| including | 1444 | 1616 | 172 | 0.721 | 1.58 | 4.02 | 1.99 | |

| EGD177 | 1405 | 1548 | 143 | 0.111 | 1.09 | 3.02 | 1.17 | |

| including | 1497 | 1548 | 51 | 0.258 | 1.75 | 4.81 | 1.92 | |

| Refer to Notes below Table 2 | ||||||||

Table 2: Underground Drill Results from 2023 Drilling at HNE Deposit1

| Drill Hole | From (m) | To (m) | Length2(m) | Gold (ppm) | Copper (%) | Silver (ppm) | CuEq3(%) | |

| UGD805B | 290 | 467.3 | 177.3 | 0.383 | 1.79 | 4.94 | 2.04 | |

| UGD807A | 56 | 190.4 | 134.4 | 0.047 | 0.70 | 1.03 | 0.74 | |

| UGD807B | 56 | 226.7 | 170.7 | 0.025 | 0.59 | 0.94 | 0.61 | |

| UGD808 | 58 | 671.6 | 613.6 | 0.132 | 0.69 | 1.53 | 0.77 | |

| including | 456 | 670 | 214 | 0.329 | 1.04 | 2.80 | 1.24 | |

| UGD813 | 380 | 436 | 56 | 0.516 | 1.45 | 3.93 | 1.75 | |

| UGD814 | 290 | 428 | 138 | 0.770 | 1.92 | 5.70 | 2.37 | |

| 1. | All the analytical results shown above are length weighted averages and are only for the portions of the drill holes on the Entrée/Oyu Tolgoi JV Property. | |||||||

| 2. | Lengths reported are drilled lengths. Approximate true widths are variable depending on the orientation of the drill hole. Several of the holes are geotechnical holes drilled subparallel to the trend of the porphyry. Other holes are drilled across the trend of the porphyry at varying orientations with estimated true widths ranging between approximately 20% and 70% of the drilled lengths. | |||||||

| 3. | CuEq is calculated by the formula CuEq = Cu + ((Au * 35.7175) + (Ag * 0.5773)) / 67.9023, taking into account differentials between metallurgical performance and price for copper, gold and silver. Metal prices used are US$3.08/lb Cu, US$1,292.00/oz Au, and US$19.00/oz Ag. Metallurgical recoveries used are 82% for copper, 73% for gold and 78% for silver. | |||||||

Figure 1: Plan View of 2023 Drilling at the HNE Deposit Showing Newly Available Assay Results

2023 DRILLING INFORMATION

Surface and underground drill holes from the 2023 program were designed to achieve multiple objectives: as in-fill holes within the mineralized footprint of Lift 2 to support the next mineral resource estimate update; for geotechnical purposes in the areas outside of the mineralized footprint; and for metallurgical purposes. Several of the holes, denoted with letter suffix A, B, or C were drilled as “daughter holes” (wedges) from a “parent hole” at varying distances along the hole.

Surface holes UGD174 and UGD177 targeted the northern half of Lift 2, and were designed as in-fill holes, but also for geotechnical/metallurgical purposes. Underground drill holes UGD807A, UGD807B and UGD808 were primarily geotechnical holes drilled towards the north-northeast and targeting the area east of the potential Lift 2 mineralized footprint, yet all returned long intervals of lower grade, but above the cut-off grade (0.41% CuEq) used in the last mineral resource estimate (refer to press release dated June 15, 2021, titled “Entrée Resources Reports Updated Feasibility Study for its Interest in the Entrée/Oyu Tolgoi Joint Venture Property”). Three additional underground holes (UGD805B, UGD813, UGD814) were drilled at moderate dips towards the northwest or northeast and after crossing onto the Entrée/Oyu Tolgoi JV Property intersected significant grades of copper and gold in the southwest corner of HNE within the potential Lift 2 footprint.

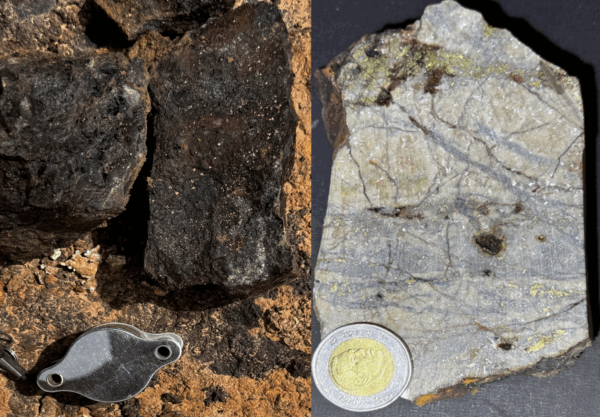

The holes drilled into the mineralized porphyry intersected predominantly phyllic and potassic altered quartz monzodiorite, cut by occasional intervals of unmineralized biotite-granodiorite dikes (generally less than 10 m in drilled width). Total sulphide content is variable but averages around 5% and comprised of a mix of chalcopyrite, bornite and pyrite hosted in quartz stockworks and disseminated form. Some of the highest-grade individual assays (grading around 5% to 10% CuEq) are often hosted within hydrothermal breccias, containing a majority of disseminated and coarse bornite and chalcopyrite.

Drill holes outside of the HNE mineralized footprint generally crossed an interbedded sequence of ignimbrite and augite basalt with varying amounts of advanced argillic and phyllic alteration. Mineralization is variable, but consists of about 3% sulphides, comprised of a mix of pyrite and chalcopyrite.

2024 HNE DRILLING UPDATE

During 2024, OTLLC has continued to drill at HNE with all holes targeting the potential Lift 2 mineralized footprint. As of October 31, 2024, OTLLC had advised approximately 5,287 metres of underground drilling in 23 diamond drill holes and 2,476 metres of surface drilling in four diamond drill holes had been completed.

No analytical data has been received for any of the 2024 HNE drill holes, but once the complete database is received from OTLLC and reviewed by the Company the results will be reported. It is the Company’s understanding that, similar to the 2022 and 2023 drilling programs, all of the 2024 drill holes will be drilled within the current mineralized footprint or within the hanging and/or footwall rocks, with the objective to update the HNE mineral resource estimate and to conduct geological and geotechnical characterization.

SAMPLE PREPARATION AND ANALYSIS, QAQC AND QUALIFIED PERSON

Drill core from the eight drill holes reported was geologically and geotechnically logged at site by OTLLC. The surface drill holes were collared with PQ diameter core (123 mm) and reduced to HQ (96 mm) core diameter at depth. Underground holes were collared using HQ diameter and occasionally reduced to NQ (76 mm) at depth. Core from HNE was saw-cut on site before being bagged and shipped to the laboratory. Sample lengths generally averaged 2.0 m. Core from HNE was shipped to ALS Laboratory (“ALS”) in Ulaanbaatar, Mongolia, for sample preparation. ALS is independent of OTLLC, Rio Tinto and Entrée. At ALS the samples were crushed to <2mm and pulverized to 75μm, then the pulps were shipped directly to ALS in Perth for analyses. Samples were analyzed for gold by ICP-MS. Samples above approximately 0.03 g/t gold were further analyzed for gold by a 30-gram fire assay with an ICP finish. Samples were also analyzed for copper, silver and molybdenum, along with eight additional elements by 4-acid digestion, ICP-MS/AES multi-element analysis. Copper samples greater than approximately 1.0% were further analyzed by ore grade ICP ES/MS method.

OTLLC follows a rigorous quality assurance/quality control (QAQC) program for the sampling programs that includes the regular insertion of standards, blanks and duplicates into the sample stream. The QP is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to in this disclosure.

The scientific and technical information that forms the basis for parts of this press release was reviewed and approved by Robert Cinits (P.Geo.), who is a Qualified Person (“QP”) as defined by National Instrument 43-101. For further information on the Entrée/Oyu Tolgoi JV Property, see the Company’s Technical Report, titled “Entrée/Oyu Tolgoi Joint Venture Project, Mongolia, NI 43-101 Technical Report”, with an effective date of October 8, 2021, available on the Company’s website at www.EntreeResourcesLtd.com, and on SEDAR+ at www.sedarplus.ca.

ABOUT ENTRÉE RESOURCES LTD.

Entrée Resources Ltd. is a well-funded Canadian mining company with a unique carried joint venture interest on a significant portion of one of the world’s largest copper-gold projects – the Oyu Tolgoi project in Mongolia. The Oyu Tolgoi project includes two separate land holdings: the Oyu Tolgoi mining licence, which is held by Entrée’s joint venture partner OTLLC and the Entrée/Oyu Tolgoi JV Property, which is a partnership between Entrée and OTLLC. Rio Tinto owns 66% of OTLLC and is the manager of operations at Oyu Tolgoi. Entrée has a 20% or 30% carried participating interest in the Entrée/Oyu Tolgoi joint venture, depending on the depth of mineralization. Horizon Copper Corp. and Rio Tinto are major shareholders of Entrée, beneficially holding approximately 24% and 16% of the shares of the Company, respectively. More information about Entrée can be found at www.EntreeResourcesLtd.com.

FURTHER INFORMATION

David Jan

Investor Relations

Entrée Resources Ltd.

Tel: 604-687-4777 | Toll Free: 1-866-368-7330

E-mail: [email protected]

This News Release contains forward-looking information within the meaning of applicable Canadian securities laws with respect to corporate strategies and plans; requirements for additional capital; uses of funds and projected expenditures; expected timing and scope of a new resource model for Hugo North (including Hugo North Extension) Lifts 1 and 2; the estimation of mineral reserves and resources; potential for additional Hugo North (including Hugo North Extension) underground lifts; potential size of a mineralized zone; potential expansion of mineralization; potential discovery of new mineralized zones; potential metallurgical recoveries and grades; plans for future exploration and/or development programs and budgets; anticipated business activities; and future financial performance.

In certain cases, forward-looking information can be identified by words such as “plans”, “expects” or “does not expect”, “is expected”, “budgeted”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will be taken”, “occur” or “be achieved”. While the Company has based forward-looking information on its expectations about future events as at the date that such information was prepared, the information is not a guarantee of Entrée’s future performance and is based on numerous assumptions regarding present and future business strategies; the correct interpretation of agreements, laws and regulations; the commencement and conclusion of arbitration proceedings, including the potential benefits, timing and outcome of arbitration proceedings; the potential benefits, timing and outcome of discussions with the Government of Mongolia, Erdenes Oyu Tolgoi LLC, OTLLC, and Rio Tinto; the future ownership of the Shivee Tolgoi and Javhlant mining licences; that the Company will continue to have timely access to detailed technical, financial, and operational information about the Entrée/Oyu Tolgoi JV Property, the Oyu Tolgoi project, and government relations to enable the Company to properly assess, act on, and disclose material risks and opportunities as they arise; local and global economic conditions and the environment in which Entrée will operate in the future, including commodity prices, projected grades, projected dilution, anticipated capital and operating costs, including inflationary pressures thereon resulting in cost escalation, and anticipated future production and cash flows; the anticipated location of certain infrastructure and sequence of mining within and across panel boundaries; the construction and continued development of the Oyu Tolgoi underground mine; the status of Entrée’s relationship and interaction with the Government of Mongolia, Erdenes Oyu Tolgoi LLC, OTLLC, and Rio Tinto; and the Company’s ability to operate sustainably, its community relations, and its social licence to operate.

With respect to the construction and continued development of the Oyu Tolgoi underground mine, important risks, uncertainties and factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking information include, amongst others, the current economic climate and the significant volatility, uncertainty and disruption arising in connection with the Ukraine conflict; the nature of the ongoing relationship and interaction between OTLLC, Rio Tinto, Erdenes Oyu Tolgoi LLC and the Government of Mongolia with respect to the continued operation and development of Oyu Tolgoi; the continuation of undercutting in accordance with the mine plans and designs in the 2023 Oyu Tolgoi Feasibility Study; applicable taxes and royalty rates; the future ownership of the Shivee Tolgoi and Javhlant mining licences; the amount of any future funding gap to complete the Oyu Tolgoi project and the availability and amount of potential sources of additional funding; the timing and cost of the construction and expansion of mining and processing facilities; inflationary pressures on prices for critical supplies for Oyu Tolgoi resulting in cost escalation; the ability of OTLLC or the Government of Mongolia to deliver a domestic power source for Oyu Tolgoi (or the availability of financing for OTLLC or the Government of Mongolia to construct such a source) within the required contractual timeframe; sources of interim power; OTLLC’s ability to operate sustainably, its community relations, and its social licence to operate in Mongolia; the impact of changes in, changes in interpretation to or changes in enforcement of, laws, regulations and government practises in Mongolia; delays, and the costs which would result from delays, in the development of the underground mine; the anticipated location of certain infrastructure and sequence of mining within and across panel boundaries; projected commodity prices and their market demand; and production estimates and the anticipated yearly production of copper, gold and silver at the Oyu Tolgoi underground mine.

Other risks, uncertainties and factors which could cause actual results, performance or achievements of Entrée to differ materially from future results, performance or achievements expressed or implied by forward-looking information include, amongst others, unanticipated costs, expenses or liabilities; discrepancies between actual and estimated production, mineral reserves and resources and metallurgical recoveries; development plans for processing resources; matters relating to proposed exploration or expansion; mining operational and development risks, including geotechnical risks and ground conditions; regulatory restrictions (including environmental regulatory restrictions and liability); risks related to international operations, including legal and political risk in Mongolia; risks related to the potential impact of global or national health concerns; risks associated with changes in the attitudes of governments to foreign investment; risks associated with the conduct of joint ventures, including the ability to access detailed technical, financial and operational information; risks related to the Company’s significant shareholders, and whether they will exercise their rights or act in a manner that is consistent with the best interests of the Company and its other shareholders; inability to upgrade Inferred mineral resources to Indicated or Measured mineral resources; inability to convert mineral resources to mineral reserves; conclusions of economic evaluations; fluctuations in commodity prices and demand; changing foreign exchange rates; the speculative nature of mineral exploration; the global economic climate; dilution; share price volatility; activities, actions or assessments by Rio Tinto or OTLLC and by government stakeholders or authorities including Erdenes Oyu Tolgoi LLC and the Government of Mongolia; the availability of funding on reasonable terms; the impact of changes in interpretation to or changes in enforcement of laws, regulations and government practices, including laws, regulations and government practices with respect to mining, foreign investment, royalties and taxation; the terms and timing of obtaining necessary environmental and other government approvals, consents and permits; the availability and cost of necessary items such as water, skilled labour, transportation and appropriate smelting and refining arrangements; unanticipated reclamation expenses; changes to assumptions as to the availability of electrical power, and the power rates used in operating cost estimates and financial analyses; changes to assumptions as to salvage values; ability to maintain the social licence to operate; accidents, labour disputes and other risks of the mining industry; global climate change; global conflicts; title disputes; limitations on insurance coverage; competition; loss of key employees; cyber security incidents; misjudgements in the course of preparing forward-looking information; and those factors discussed in the Company’s most recently filed MD&A and in the Company’s Annual Information Form for the financial year ended December 31, 2022, dated March 31, 2023 filed with the Canadian Securities Administrators and available at www.sedarplus.ca. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. The Company is under no obligation to update or alter any forward-looking information except as required under applicable securities laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ba121850-b224-49fe-9ef2-cce00fe3ea6a