(all amounts in US dollars, unless otherwise noted)

VANCOUVER, British Columbia, Nov. 05, 2024 (GLOBE NEWSWIRE) — Ero Copper Corp. (TSX: ERO, NYSE: ERO) (“Ero” or the “Company”) is pleased to announce its operating and financial results for the three and nine months ended September 30, 2024. Management will host a conference call tomorrow, Wednesday, November 6, 2024, at 11:30 a.m. eastern time to discuss the results. Dial-in details for the call can be found near the end of this press release.

HIGHLIGHTS

- The Tucumã Operation achieved a major commissioning milestone in July 2024, producing its first saleable copper concentrate. As ramp-up efforts increased mill throughput during the quarter, the operation delivered 839 tonnes of copper, contributing to consolidated quarterly copper production of 10,759 tonnes.

- Consolidated quarterly copper production also included contributions from the Caraíba Operations of 9,920 tonnes at C1 cash costs(*) of $1.63 per pound of copper produced.

- Gold production for the quarter was 13,485 ounces at C1 cash costs(*) and All-in Sustaining Costs (“AISC”)(*) of $539 and $1,034, respectively, per ounce produced.

- Improved operating margins were supported by a significant decrease in unit operating costs at the Caraíba Operations and higher realized gold prices at the Xavantina Operations, resulting in:

- Net income attributable to the owners of the Company of $40.9 million, or $0.39 per share on a diluted basis.

- Adjusted net income attributable to the owners of the Company(*) of $27.6 million, or $0.27 per share on a diluted basis.

- Adjusted EBITDA(*) of $62.2 million.

- Available liquidity at quarter-end was $125.2 million, including $20.2 million in cash and cash equivalents, $80.0 million of undrawn availability under the Company’s senior secured revolving credit facility, and $25.0 million of undrawn availability under the copper prepayment facility.

(*)These are non-IFRS measures and do not have a standardized meaning prescribed by IFRS and might not be comparable to similar financial measures disclosed by other issuers. Please refer to the Company’s discussion of Non-IFRS measures in its Management’s Discussion and Analysis for the three and nine months ended September 30, 2024 and the Reconciliation of Non-IFRS Measures section at the end of this press release.

- During the quarter, the Company opportunistically entered into zero-cost gold collar contracts on 2,500 ounces of gold per month from January 2025 to December 2025, representing just over 50% of projected 2025 gold production at the Xavantina Operations. These contracts set a floor price of $2,200 per ounce, while allowing for upside participation in gold price increases up to a cap of $3,425 per ounce, over 20% above the all-time high price reached in October 2024.

- Key 2024 guidance updates include:

- The Company is updating consolidated copper production guidance to 43,000 to 48,000 tonnes in concentrate, reflecting an extension of Tucumã’s ramp-up schedule due to power disruptions in Q3 and October 2024 and slower-than- expected underground development progress at Caraíba’s Pilar Mine.

- Due to the anticipated delay in achieving commercial production at the Tucumã Operation, the Company is narrowing 2024 C1 cash cost guidance to only include the Caraíba Operations. The Company is reaffirming full-year C1 cash cost guidance for the Caraíba Operations of $1.80 to $2.00 per pound of copper produced.

- Full-year gold production guidance is being maintained at the increased range of 60,000 to 65,000. The Company is also reaffirming reduced full-year gold cost guidance of $450 to $550 per ounce of produced for C1 cash costs, and $900 to $1,000 per ounce for AISC.

- The Company is maintaining full-year consolidated capital expenditure guidance of $303 to $348 million.

“The third quarter and year-to-date period presented both significant achievements to celebrate and new challenges to navigate,” said David Strang, Chief Executive Officer. “We have reached the inflection point we have been working towards since the publication of Tucumã’s Optimized Feasibility Study in September 2021. With construction complete and ramp-up to commercial production underway, reaching this milestone in just over three years is a remarkable accomplishment.

“Alongside this achievement, came operational headwinds, including power-related challenges that have impacted our ramp-up schedule at Tucumã. At our Caraíba Operations, we made progress in accelerating underground development rates at the Pilar Mine, though the performance of a third-party development contractor has been below expectations. We view these challenges as transitional, and our team is actively working on returning to plan.

“Despite these setbacks, our financial results have been strengthened by improved operating margins driven by significantly lower unit costs at Caraíba and higher realized gold prices at Xavantina. We are optimistic about the path ahead, with 2025 on track to be our best year yet, and look forward to delivering strong value for our stakeholders.”

THIRD QUARTER REVIEW

The Caraíba Operations

- Quarterly copper production at the Caraíba Operation increased 11.9% quarter-on- quarter to 9,920 tonnes of copper in concentrate, with higher mined and processed copper grades offsetting lower mill throughput.

- Higher copper grades also contributed to a 24.5% decrease in C1 cash costs, which averaged $1.63 per pound of copper produced for the quarter. C1 cash costs and margins also benefited from improved concentrate treatment and refining charges, secured as of May 2024, as well as a more favorable USD to BRL exchange rate.

- Efforts to increase underground development rates at the Pilar Mine were impacted by slower-than-anticipated progress by a third-party development contractor during the quarter. Consequently, the Company expects lower mined and processed tonnage at the Caraíba Operations through year-end.

- To support accelerated development rates, the Company intends to engage an additional contractor in Q4 2024.

The Tucumã Operation

- The Tucumã Operation successfully produced first saleable concentrate in July 2024. Production for the quarter was 839 tonnes of copper in concentrate, with mill throughput totaling 110,778 tonnes and metallurgical recoveries averaging 75.7%.

- Mining operations continued ahead of schedule, contributing to a buildup of ore stockpiles that are expected to be processed in Q4 2024 and throughout 2025.

- The ramp-up of Tucumã’s processing plant progressed well through July and the majority of August; however, as the plant moved toward continuous operations, the Company detected intermittent voltage oscillations within the third-party regional power grid. These oscillations limited the ability to run the mill at full capacity on a continuous basis.

- Subsequent to quarter-end, the Tucumã Operation experienced a temporary power disruption following a severe localized windstorm that impacted the regional power grid, including the main 230kV transmission line servicing the southwest region of the Carajás Mineral Province. Power was restored after approximately 10 days, allowing the Company to safely resume ramp-up activities on October 16, 2024.(1)

- To address ongoing intermittent voltage oscillations, the Company implemented a mill power management solution that enables continuous plant operations despite minor voltage fluctuations. Since this implementation, the plant has maintained continuous operations and is advancing toward full capacity.

(1)For further details on the power disruption and resumption of ramp-up activities, please refer the Company’s press releases dated October 5, 2024 and October 16, 2024.

The Xavantina Operations

- Quarterly gold production at the Xavantina Operations totaled 13,485 ounces with tonnes processed up 3.3% quarter-on-quarter, partially offsetting a planned decrease in mined and processed gold grades.

- Unit operating costs were in line with expectations for the quarter, averaging $539 per ounce for C1 cash costs and $1,034 per ounce for AISC.

- The Xavantina Operations are expected to deliver similar production levels and unit cost performance in Q4 2024 compared to Q3 2024.

OTHER SUBSEQUENT EVENTS

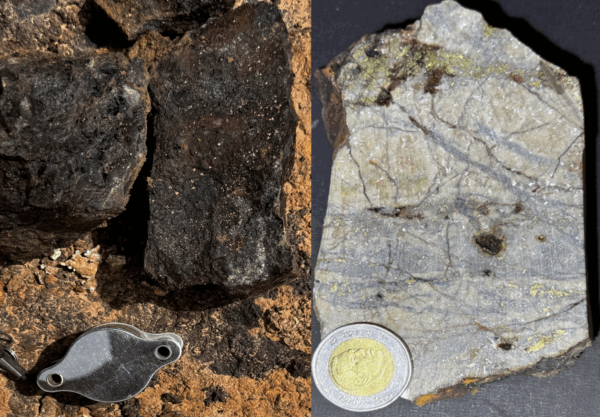

The Company continued to advance its growth pipeline with the announcement of an initial National Instrument 43-101 compliant mineral resource estimate for Furnas Copper-Gold Project (the “Project”) on October 2, 2024. This initial mineral resource estimate, supported by over 90,000 meters of historic drilling, highlights the significant potential of this Project.

In October 2024, the Company also commenced the Phase 1 drill program under the definitive earn-in agreement(1) for the Project, after receiving drilling permits from the Pará State environmental agency in September 2024. This minimum 28,000-meter program, designed to support a preliminary economic assessment on the Project, is focused on infill drilling and extending high-grade zones within the broader deposit to depth. For more information on the Project’s initial mineral resource estimate and the Phase 1 drill program, please refer to the Company’s press release dated October 2, 2024.

(1)In July 2024, the Company signed a definitive earn-in agreement (“Agreement”) with Salobo Metais S.A., a subsidiary of Vale Base Metals Limited, to earn a 60% interest in the Project, located in the Carajás Mineral Province in Pará State, Brazil. The terms of the Agreement align with the previously signed binding term sheet outlined in the Company’s press release dated October 30, 2023.

| OPERATING HIGHLIGHTS | ||||||||||

| 2024 – Q3 | 2024 – Q2 | 2023 – Q3 | 2024 – YTD | 2023 – YTD | ||||||

| Copper (Caraíba Operations) | ||||||||||

| Ore Processed (tonnes) | 900,289 | 957,692 | 806,096 | 2,711,352 | 2,419,465 | |||||

| Grade (% Cu) | 1.20 | 1.03 | 1.46 | 1.10 | 1.45 | |||||

| Cu Production (tonnes) | 9,920 | 8,867 | 10,766 | 26,878 | 32,097 | |||||

| Cu Production (000 lbs) | 21,871 | 19,548 | 23,734 | 59,257 | 70,761 | |||||

| Cu Sold in Concentrate (tonnes) | 9,970 | 8,706 | 10,090 | 28,137 | 31,166 | |||||

| Cu Sold in Concentrate (000 lbs) | 21,980 | 19,192 | 22,244 | 62,031 | 68,709 | |||||

| Cu C1 cash cost(1)(2) | $ | 1.63 | $ | 2.16 | $ | 1.92 | $ | 2.01 | $ | 1.83 |

| Copper (Tucumã Operation) | ||||||||||

| Ore Processed (tonnes) | 110,778 | — | — | 110,778 | — | |||||

| Grade (% Cu) | 1.00 | — | — | 1.00 | — | |||||

| Cu Production (tonnes) | 839 | — | — | 839 | — | |||||

| Cu Production (000 lbs) | 1,850 | — | — | 1,850 | — | |||||

| Cu Sold in Concentrate (tonnes) | 357 | — | — | 357 | — | |||||

| Cu Sold in Concentrate (000 lbs) | 787 | — | — | 787 | — | |||||

| Gold (Xavantina Operations) | ||||||||||

| Ore Processed (tonnes) | 41,761 | 40,446 | 31,446 | 120,041 | 101,586 | |||||

| Grade (g / tonne) | 11.41 | 14.00 | 18.72 | 13.85 | 14.43 | |||||

| Au Production (oz) | 13,485 | 16,555 | 17,579 | 48,274 | 42,355 | |||||

| Au C1 cash cost(1) | $ | 539 | $ | 428 | $ | 371 | $ | 447 | $ | 425 |

| Au AISC(1) | $ | 1,034 | $ | 842 | $ | 844 | $ | 879 | $ | 943 |

(1)EBITDA, adjusted EBITDA, adjusted net income (loss) attributable to owners of the Company, adjusted net income (loss) per share attributable to owners of the Company, net (cash) debt, working capital, copper C1 cash cost, copper C1 cash cost including foreign exchange hedges, gold C1 cash cost and gold AISC are non- IFRS measures. These measures do not have a standardized meaning prescribed by IFRS and might not be comparable to similar financial measures disclosed by other issuers. Please refer to the Company’s discussion of Non-IFRS measures in its Management’s Discussion and Analysis for the three and nine months ended September 30, 2024 and the Reconciliation of Non-IFRS Measures section at the end of this press release.

(2)Copper C1 cash cost including foreign exchange hedges was $1.72 in Q3 2024 (Q3 2023 – $1.77) and $2.04 in YTD 2024 (YTD 2024 – $1.73).

FINANCIAL HIGHLIGHTS

($ in millions, except per share amounts)

| 2024 – Q3 | 2024 – Q2 | 2023 – Q3 | 2024 – YTD | 2023 – YTD | |||||||||

| Revenues | $ | 124.8 | $ | 117.1 | $ | 105.2 | $ | 347.7 | $ | 311.1 | |||

| Gross profit | 53.7 | 43.3 | 35.5 | 128.2 | 115.0 | ||||||||

| EBITDA(1) | 74.5 | (36.2 | ) | 28.3 | 56.1 | 135.0 | |||||||

| Adjusted EBITDA(1) | 62.2 | 51.5 | 42.9 | 157.0 | 133.2 | ||||||||

| Cash flow from operations | 52.7 | 14.7 | 41.9 | 84.6 | 113.7 | ||||||||

| Net income (loss) | 41.4 | (53.4 | ) | 2.8 | (18.9 | ) | 57.3 | ||||||

| Net income (loss) attributable to owners of the | 40.9 | (53.2 | ) | 2.5 | (19.5 | ) | 56.3 | ||||||

| Per share (basic) | 0.40 | (0.52 | ) | 0.03 | (0.19 | ) | 0.61 | ||||||

| Per share (diluted) | 0.39 | (0.52 | ) | 0.03 | (0.19 | ) | 0.60 | ||||||

| Adjusted net income attributable to owners of the Company(1) | 27.6 | 18.6 | 17.3 | 63.0 | 62.0 | ||||||||

| Per share (basic) | 0.27 | 0.18 | 0.19 | 0.61 | 0.67 | ||||||||

| Per share (diluted) | 0.27 | 0.18 | 0.18 | 0.61 | 0.66 | ||||||||

| Cash, cash equivalents, and short-term | 20.2 | 44.8 | 87.6 | 20.2 | 87.6 | ||||||||

| Working (deficit) capital(1) | (60.9 | ) | (57.6 | ) | 32.8 | (60.9 | ) | 32.8 | |||||

| Net debt(1) | 518.7 | 482.0 | 331.8 | 518.7 | 331.8 | ||||||||

(1)EBITDA, adjusted EBITDA, adjusted net income (loss) attributable to owners of the Company, adjusted net income (loss) per share attributable to owners of the Company, net (cash) debt, working capital, copper C1 cash cost, copper C1 cash cost including foreign exchange hedges, gold C1 cash cost and gold AISC are non- IFRS measures. These measures do not have a standardized meaning prescribed by IFRS and might not be comparable to similar financial measures disclosed by other issuers. Please refer to the Company’s discussion of Non-IFRS measures in its Management’s Discussion and Analysis for the three and nine months ended September 30, 2024 and the Reconciliation of Non-IFRS Measures section at the end of this press release.

2024 GUIDANCE(*)

The Company is updating production guidance for both the Caraíba and Tucumã Operations, resulting in a consolidated copper production guidance for the year of 43,000 to 48,000 tonnes in concentrate.

Due to the anticipated delay in achieving commercial production at the Tucumã Operation, the Company is narrowing 2024 C1 cash cost guidance to only include the Caraíba Operations. The Company is reaffirming full-year C1 cash cost guidance for the Caraíba Operations of $1.80 to $2.00 per pound of copper produced. Positive factors, including improved concentrate treatment and refining charges secured as of May 2024, a higher gold byproduct credit, and a more favorable USD to BRL exchange rate, are expected to more than offset the impact of lower projected copper production.

At the Xavantina Operations, the Company is reaffirming increased full-year gold production guidance of 60,000 to 65,000 ounces, with similar production levels and unit cost performance expected in Q4 2024 compared to Q3 2024. Consequently, the Company is reaffirming its reduced gold cost guidance ranges, including C1 cash cost guidance of $450 to $550 per ounce, and AISC guidance of $900 to $1,000 per ounce.

The Company is also maintaining consolidated 2024 capital expenditure guidance of $303 to $348 million.

The Company’s cost guidance for 2024 assumes a foreign exchange rate of 5.00 BRL per USD, a gold price of $1,900 per ounce and a silver price of $23.00 per ounce for Q4 2024.

| Original Guidance | Updated Guidance | |

| Consolidated Copper Production (tonnes) | ||

| Caraíba Operations | 42,000 – 47,000 | 35,000 – 37,000 |

| Tucumã Operation | 17,000 – 25,000 | 8,000 – 11,000 |

| Total | 59,000 – 72,000 | 43,000 – 48,000 |

| Caraíba Operations C1 Cash Cost(1)Guidance | $1.80 – $2.00 | Unchanged |

| The Xavantina Operations | ||

| Au Production (ounces) | 55,000 – 60,000 | 60,000 – 65,000 |

| Gold C1 Cash Cost(1) Guidance | $550 – $650 | $450 – $550 |

| Gold AISC(1) Guidance | $1,050 – $1,150 | $900 – $1,000 |

*Guidance is based on certain estimates and assumptions, including but not limited to, mineral reserve estimates, grade and continuity of interpreted geological formations and metallurgical performance. Please refer to the Company’s most recent Annual Information Form and Management of Risks and Uncertainties in the MD&A for complete risk factors.

(1)Please refer to the section titled “Alternative Performance (Non-IFRS) Measures” within the MD&A.

CONFERENCE CALL DETAILS

The Company will hold a conference call on Wednesday, November 6, 2024 at 11:30 am Eastern time (8:30 am Pacific time) to discuss these results.

| Date: | Wednesday, November 6, 2024 |

| Time: | 11:30 am Eastern time (8:30 am Pacific time) |

| Dial in: | Canada/USA Toll Free: 1-844-763-8274, International: +1-647-484-8814 Please dial in 5-10 minutes prior to the start of the call or pre-register using this link to bypass the live operator queue |

| Webcast: | To access the webcast, click here |

| Replay: | Canada/USA: 1-855-669-9658, International: +1-412-317-0088 For country-specific dial-in numbers, click here |

| Replay Passcode: | 1437453 |

Reconciliation of Non-IFRS Measures

Financial results of the Company are presented in accordance with IFRS. The Company utilizes certain alternative performance (non-IFRS) measures to monitor its performance, including copper C1 cash cost, copper C1 cash cost including foreign exchange hedges, gold C1 cash cost, gold AISC, EBITDA, adjusted EBITDA, adjusted net income attributable to owners of the Company, adjusted net income per share, net (cash) debt, working capital and available liquidity. These performance measures have no standardized meaning prescribed within generally accepted accounting principles under IFRS and, therefore, amounts presented may not be comparable to similar measures presented by other mining companies. These non-IFRS measures are intended to provide supplemental information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

For additional details please refer to the Company’s discussion of non-IFRS and other performance measures in its Management’s Discussion and Analysis for the three and nine months ended September 30, 2024 which is available on SEDAR+ at www.sedarplus.ca, and on EDGAR at www.sec.gov.

Copper C1 cash cost and copper C1 cash cost including foreign exchange hedges

The following table provides a reconciliation of copper C1 cash cost to cost of production, its most directly comparable IFRS measure.

| Reconciliation: | 2024 – Q3 | 2024 – Q2 | 2023 – Q3 | 2024 – YTD | 2023 – YTD | ||||||||||

| Cost of production | $ | 40,149 | $ | 41,945 | $ | 39,345 | $ | 124,321 | $ | 113,397 | |||||

| Add (less): | |||||||||||||||

| Transportation costs & other | 1,283 | 1,283 | 1,614 | 3,818 | 4,686 | ||||||||||

| Treatment, refining, and other | 3,170 | 4,058 | 6,574 | 12,398 | 20,991 | ||||||||||

| By-product credits | (6,584 | ) | (3,431 | ) | (3,022 | ) | (12,455 | ) | (9,536 | ) | |||||

| Incentive payments | (1,138 | ) | (1,174 | ) | (1,609 | ) | (3,511 | ) | (3,975 | ) | |||||

| Net change in inventory | (1,220 | ) | (468 | ) | 2,835 | (5,581 | ) | 2,973 | |||||||

| Foreign exchange translation and other | 3 | 21 | (171 | ) | 17 | (169 | ) | ||||||||

| C1 cash costs | 35,663 | 42,234 | 45,566 | 119,007 | 128,367 | ||||||||||

| (Gain) loss on foreign exchange hedges | 1,965 | 46 | (3,458 | ) | 1,735 | (7,232 | ) | ||||||||

| C1 cash costs including foreign exchange hedges | $ | 37,628 | $ | 42,280 | $ | 42,108 | $ | 120,742 | $ | 121,135 | |||||

| Mining | $ | 26,529 | $ | 27,881 | $ | 27,258 | $ | 79,666 | $ | 76,262 | |||||

| Processing | 7,069 | 7,927 | 8,362 | 22,173 | 22,559 | ||||||||||

| Indirect | 5,479 | 5,799 | 6,394 | 17,225 | 18,091 | ||||||||||

| Production costs | 39,077 | 41,607 | 42,014 | 119,064 | 116,912 | ||||||||||

| By-product credits | (6,584 | ) | (3,431 | ) | (3,022 | ) | (12,455 | ) | (9,536 | ) | |||||

| Treatment, refining and other | 3,170 | 4,058 | 6,574 | 12,398 | 20,991 | ||||||||||

| C1 cash costs | 35,663 | 42,234 | 45,566 | 119,007 | 128,367 | ||||||||||

| (Gain) loss on foreign exchange hedges | 1,965 | 46 | (3,458 | ) | 1,735 | (7,232 | ) | ||||||||

| C1 cash costs including foreign exchange hedges | $ | 37,628 | $ | 42,280 | $ | 42,108 | $ | 120,742 | $ | 121,135 | |||||

|

Costs per pound |

|||||||||||||||

| Total copper produced (lbs, 000) | 21,871 | 19,548 | 23,734 | 59,257 | 70,761 | ||||||||||

| Mining | $ | 1.22 | $ | 1.42 | $ | 1.15 | $ | 1.34 | $ | 1.08 | |||||

| Processing | $ | 0.32 | $ | 0.41 | $ | 0.35 | $ | 0.38 | $ | 0.32 | |||||

| Indirect | $ | 0.25 | $ | 0.30 | $ | 0.27 | $ | 0.29 | $ | 0.26 | |||||

| By-product credits | $ | (0.30 | ) | $ | (0.18 | ) | $ | (0.13 | ) | $ | (0.21 | ) | $ | (0.13 | ) |

| Treatment, refining and other | $ | 0.14 | $ | 0.21 | $ | 0.28 | $ | 0.21 | $ | 0.30 | |||||

| Copper C1 cash costs | $ | 1.63 | $ | 2.16 | $ | 1.92 | $ | 2.01 | $ | 1.83 | |||||

| (Gain) loss on foreign exchange hedges | $ | 0.09 | $ | — | $ | (0.15 | ) | $ | 0.03 | $ | (0.10 | ) | |||

| Copper C1 cash costs including foreign exchange hedges | $ | 1.72 | $ | 2.16 | $ | 1.77 | $ | 2.04 | $ | 1.73 | |||||

Gold C1 cash cost and gold AISC

The following table provides a reconciliation of gold C1 cash cost and gold AISC to cost of production, its most directly comparable IFRS measure.

| Reconciliation: | 2024 – Q3 | 2024 – Q2 | 2023 – Q3 | 2024 – YTD | 2023 – YTD | ||||||||||||||

| Cost of production | $ | 6,220 | $ | 7,580 | $ | 6,323 | $ | 21,055 | $ | 18,087 | |||||||||

| Add (less): | |||||||||||||||||||

| Incentive payments | (378 | ) | (226 | ) | (320 | ) | (1,047 | ) | (1,038 | ) | |||||||||

| Net change in inventory | 1,378 | (322 | ) | 213 | 1,320 | 797 | |||||||||||||

| By-product credits | (232 | ) | (259 | ) | (240 | ) | (680 | ) | (579 | ) | |||||||||

| Smelting and refining | 79 | 97 | 101 | 266 | 240 | ||||||||||||||

| Foreign exchange translation and other | 203 | 215 | 453 | 650 | 510 | ||||||||||||||

| C1 cash costs | $ | 7,270 | $ | 7,085 | $ | 6,530 | $ | 21,564 | $ | 18,017 | |||||||||

| Site general and administrative | 1,321 | 1,350 | 1,304 | 4,024 | 3,874 | ||||||||||||||

| Accretion of mine closure and rehabilitation provision | 82 | 88 | 112 | 262 | 328 | ||||||||||||||

| Sustaining capital expenditure | 2,784 | 2,653 | 4,258 | 8,691 | 10,801 | ||||||||||||||

| Sustaining lease payments | 1,801 | 1,908 | 1,832 | 5,831 | 5,232 | ||||||||||||||

| Royalties and production taxes | 686 | 862 | 808 | 2,058 | 1,702 | ||||||||||||||

| AISC | $ | 13,944 | $ | 13,946 | $ | 14,844 | $ | 42,430 | $ | 39,954 | |||||||||

| Costs | |||||||||||||||

| Mining | $ | 3,852 | $ | 3,705 | $ | 3,140 | $ | 11,377 | $ | 8,724 | |||||

| Processing | 2,419 | 2,277 | 2,165 | 6,955 | 6,118 | ||||||||||

| Indirect | 1,152 | 1,265 | 1,364 | 3,646 | 3,514 | ||||||||||

| Production costs | 7,423 | 7,247 | 6,669 | 21,978 | 18,356 | ||||||||||

| Smelting and refining costs | 79 | 97 | 101 | 266 | 240 | ||||||||||

| By-product credits | (232 | ) | (259 | ) | (240 | ) | (680 | ) | (579 | ) | |||||

| C1 cash costs | $ | 7,270 | $ | 7,085 | $ | 6,530 | $ | 21,564 | $ | 18,017 | |||||

| Site general and administrative | 1,321 | 1,350 | 1,304 | 4,024 | 3,874 | ||||||||||

| Accretion of mine closure and rehabilitation provision | 82 | 88 | 112 | 262 | 328 | ||||||||||

| Sustaining capital expenditure | 2,784 | 2,653 | 4,258 | 8,691 | 10,801 | ||||||||||

| Sustaining leases | 1,801 | 1,908 | 1,832 | 5,831 | 5,232 | ||||||||||

| Royalties and production taxes | 686 | 862 | 808 | 2,058 | 1,702 | ||||||||||

| AISC | $ | 13,944 | $ | 13,946 | $ | 14,844 | $ | 42,430 | $ | 39,954 | |||||

| Costs per ounce | |||||||||||||||

| Total gold produced (ounces) | 13,485 | 16,555 | 17,579 | 48,274 | 42,355 | ||||||||||

|

Mining |

$ |

286 |

$ |

224 |

$ |

179 |

$ |

236 |

$ |

206 |

|||||

| Processing | $ | 179 | $ | 138 | $ | 123 | $ | 144 | $ | 144 | |||||

| Indirect | $ | 85 | $ | 76 | $ | 78 | $ | 76 | $ | 83 | |||||

| Smelting and refining | $ | 6 | $ | 6 | $ | 6 | $ | 6 | $ | 6 | |||||

| By-product credits | $ | (17 | ) | $ | (16 | ) | $ | (15 | ) | $ | (15 | ) | $ | (14 | ) |

| Gold C1 cash cost | $ | 539 | $ | 428 | $ | 371 | $ | 447 | $ | 425 | |||||

| Gold AISC | $ | 1,034 | $ | 842 | $ | 844 | $ | 879 | $ | 943 | |||||

Earnings before interest, taxes, depreciation and amortization (EBITDA) and Adjusted EBITDA

The following table provides a reconciliation of EBITDA and Adjusted EBITDA to net income, its most directly comparable IFRS measure.

| Reconciliation: | 2024 – Q3 | 2024 – Q2 | 2023 – Q3 | 2024 – YTD | 2023 – YTD | |||||||||||||

| Net Income (Loss) | $ | 41,367 | $ | (53,399 | ) | $ | 2,811 | $ | (18,862 | ) | $ | 57,252 | ||||||

| Adjustments: | ||||||||||||||||||

| Finance expense | 4,039 | 4,565 | 8,017 | 13,238 | 20,538 | |||||||||||||

| Finance income | (781 | ) | (1,361 | ) | (2,976 | ) | (3,610 | ) | (10,476 | ) | ||||||||

| Income tax expense (recovery) | 8,331 | (8,267 | ) | (807 | ) | (1,789 | ) | 9,632 | ||||||||||

| Amortization and depreciation | 21,555 | 22,294 | 21,299 | 67,145 | 58,044 | |||||||||||||

| EBITDA | $ | 74,511 | $ | (36,168 | ) | $ | 28,344 | $ | 56,122 | $ | 134,990 | |||||||

| Foreign exchange (gain) loss | (17,246 | ) | 70,454 | 13,937 | 72,204 | (9,741 | ) | |||||||||||

| Share based compensation | 4,859 | 6,075 | (1,185 | ) | 17,479 | 8,741 | ||||||||||||

| Write-down of exploration and evaluation asset | 467 | 10,745 | — | 11,212 | — | |||||||||||||

| Unrealized (gain) loss on commodity derivatives | (360 | ) | 436 | 1,814 | 12 | (840 | ) | |||||||||||

| Adjusted EBITDA | $ | 62,231 | $ | 51,542 | $ | 42,910 | $ | 157,029 | $ | 133,150 | ||||||||

Adjusted net income attributable to owners of the Company and Adjusted net income per share attributable to owners of the Company

The following table provides a reconciliation of Adjusted net income attributable to owners of the Company and Adjusted EPS to net income attributable to the owners of the Company, its most directly comparable IFRS measure.

| Reconciliation: | 2024 – Q3 | 2024 – Q2 | 2023 – Q3 | 2024 – YTD | 2023 – YTD | ||||||||||

| Net income (loss) as reported attributable to the | |||||||||||||||

| owners of the Company | $ | 40,857 | $ | (53,247 | ) | $ | 2,525 | $ | (19,531 | ) | $ | 56,255 | |||

| Adjustments: | |||||||||||||||

| Share based compensation | 4,859 | 6,075 | (1,185 | ) | 17,479 | 8,741 | |||||||||

| Unrealized foreign exchange (gain) loss on USD | |||||||||||||||

| denominated balances in MCSA | (11,860 | ) | 48,517 | 9,481 | 47,914 | (4,988 | ) | ||||||||

| Unrealized foreign exchange (gain) loss on foreign exchange derivative contracts | (9,807 | ) | 16,006 | 7,530 | 15,503 | 2,300 | |||||||||

| Write-down of exploration and evaluation asset | 465 | 10,745 | — | 11,210 | — | ||||||||||

| Unrealized (gain) loss on commodity derivatives | (367 | ) | 434 | 1,808 | 3 | (836 | ) | ||||||||

| Tax effect on the above adjustments | 3,431 | (9,904 | ) | (2,873 | ) | (9,601 | ) | 540 | |||||||

| Adjusted net income attributable to owners of the Company | $ | 27,578 | $ | 18,626 | $ | 17,286 | $ | 62,977 | $ | 62,012 | |||||

|

Weighted average number of common shares |

|||||||||||||||

| Basic | 103,239,881 | 103,082,363 | 93,311,434 | 103,026,138 | 92,767,525 | ||||||||||

| Diluted | 103,973,827 | 103,961,615 | 94,009,268 | 103,742,304 | 93,643,940 | ||||||||||

|

Adjusted EPS |

|||||||||||||||

| Basic | $ | 0.27 | $ | 0.18 | $ | 0.19 | $ | 0.61 | $ | 0.67 | |||||

| Diluted | $ | 0.27 | $ | 0.18 | $ | 0.18 | $ | 0.61 | $ | 0.66 | |||||

Net Debt (Cash)

The following table provides a calculation of net debt (cash) based on amounts presented in the Company’s condensed consolidated interim financial statements as at the periods presented.

| September | June 30, | December 31, | September | ||||||||||||

| 30, 2024 | 2024 | 2023 | 30, 2023 | ||||||||||||

| Current portion of loans and borrowings | $ | 39,383 | $ | 39,889 | $ | 20,381 | $ | 11,764 | |||||||

| Long-term portion of loans and borrowings | 499,527 | 486,919 | 405,852 | 407,656 | |||||||||||

| Less: | |||||||||||||||

| Cash and cash equivalents | (20,229 | ) | (44,773 | ) | (111,738 | ) | (44,757 | ) | |||||||

| Short-term investments | — | — | — | (42,843 | ) | ||||||||||

| Net debt (cash) | $ | 518,681 | $ | 482,035 | $ | 314,495 | $ | 331,820 | |||||||

Working Capital and Available Liquidity

The following table provides a calculation for these based on amounts presented in the Company’s condensed consolidated interim financial statements as at the periods presented.

| September | June 30, | December 31, | September | ||||||||||||

| 30, 2024 | 2024 | 2023 | 30, 2023 | ||||||||||||

| Current assets | $ | 126,808 | $ | 124,554 | $ | 199,487 | $ | 174,113 | |||||||

| Less: Current liabilities | (187,708 | ) | (182,143 | ) | (173,800 | ) | (141,284 | ) | |||||||

| Working (deficit) capital | $ | (60,900 | ) | $ | (57,589 | ) | $ | 25,687 | $ | 32,829 | |||||

| Cash and cash equivalents | 20,229 | 44,773 | 111,738 | 44,757 | |||||||||||

| Short-term investments | — | — | — | 42,843 | |||||||||||

| Available undrawn revolving credit facilities | 80,000 | 100,000 | 150,000 | 150,000 | |||||||||||

| Available undrawn prepayment facilities(1) | $ | 25,000 | $ | 25,000 | $ | — | $ | — | |||||||

| Available liquidity | $ | 125,229 | $ | 169,773 | $ | 261,738 | $ | 237,600 | |||||||

(1) In May 2024, the Company entered into a $50.0 million non-priced copper prepayment facility arrangement. Through the end of 2024, the Company has the option to increase the size of the facility from $50.0 million to $75.0 million.

ABOUT ERO COPPER CORP

Ero Copper is a high-margin, high-growth copper producer with operations in Brazil and corporate headquarters in Vancouver, B.C. The Company’s primary asset is a 99.6% interest in the Brazilian copper mining company, Mineração Caraíba S.A. (“MCSA”), 100% owner of the Company’s Caraíba Operations (formerly known as the MCSA Mining Complex), which are located in the Curaçá Valley, Bahia State, Brazil and include the Pilar and Vermelhos underground mines and the Surubim open pit mine, and the Tucumã Operation (formerly known as Boa Esperança), an open pit copper mine located in Pará, Brazil. The Company also owns 97.6% of NX Gold S.A. (“NX Gold”) which owns the Xavantina Operations (formerly known as the NX Gold Mine), comprised of an operating gold and silver mine located in Mato Grosso, Brazil. Additional information on the Company and its operations, including technical reports on the Caraíba Operations, Xavantina Operations and Tucumã Operation, can be found on SEDAR+ (www.sedarplus.ca/landingpage/) and on EDGAR (www.sec.gov). The Company’s shares are publicly traded on the Toronto Stock Exchange and the New York Stock Exchange under the symbol “ERO”.

FOR MORE INFORMATION, PLEASE CONTACT

Courtney Lynn, SVP, Corporate Development, Investor Relations & Sustainability

(604) 335-7504

[email protected]

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS

This press release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). Forward-looking statements include statements that use forward-looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Forward-looking statements may include, but are not limited to, statements with respect to the Company’s expected production, operating costs and capital expenditures at the Caraíba Operations, the Tucumã Operation and the Xavantina Operations; estimated timing for certain milestones, including resolution of power-related challenges and ramp-up of production levels at the Tucumã Operation; the Company’s ability to engage an additional underground development contractor and accelerate development rates at the Pilar Mine; expectations related to foreign exchange rates as well as copper concentrate treatment and refining charges; and any other statement that may predict, forecast, indicate or imply future plans, intentions, levels of activity, results, performance or achievements.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual results, actions, events, conditions, performance or achievements to materially differ from those expressed or implied by the forward-looking statements, including, without limitation, risks discussed in this press release and in the Company’s Annual Information Form for the year ended December 31, 2023 (“AIF”) under the heading “Risk Factors”. The risks discussed in this press release and in the AIF are not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results, actions, events, conditions, performance or achievements to differ materially from those contained in forward-looking statements, there may be other factors that cause results, actions, events, conditions, performance or achievements to differ from those anticipated, estimated or intended.

Forward-looking statements are not a guarantee of future performance. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve statements about the future and are inherently uncertain, and the Company’s actual results, achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to herein and in the AIF under the heading “Risk Factors”.

The Company’s forward-looking statements are based on the assumptions, beliefs, expectations and opinions of management on the date the statements are made, many of which may be difficult to predict and beyond the Company’s control. In connection with the forward-looking statements contained in this press release and in the AIF, the Company has made certain assumptions about, among other things: favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development and exploration of the Company’s properties and assets; future prices of copper, gold and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the Caraíba Operations, the Xavantina Operations and the Tucumã Operation being as described in the respective technical report for each property; production costs; the accuracy of budgeted exploration, development and construction costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force continuing to remain healthy in the face of prevailing epidemics, pandemics or other health risks, political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. Although the Company believes that the assumptions inherent in forward-looking statements are reasonable as of the date of this press release, these assumptions are subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking statements. The Company cautions that the foregoing list of assumptions is not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking statements contained in this press release. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

Unless otherwise indicated, all reserve and resource estimates included in this press release and the documents incorporated by reference herein have been prepared in accordance with National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101″) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and reserve and resource information included herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this press release and the documents incorporated by reference herein use the terms “measured resources,” “indicated resources” and “inferred resources” as defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property disclosure requirements in the United States (the “U.S. Rules”) are governed by subpart 1300 of Regulation S-K of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) which differ from the CIM Standards. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system (the “MJDS”), Ero is not required to provide disclosure on its mineral properties under the U.S. Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. If Ero ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the MJDS, then Ero will be subject to the U.S. Rules, which differ from the requirements of NI 43-101 and the CIM Standards.

Pursuant to the new U.S. Rules, the SEC recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the definitions of “proven mineral reserves” and “probable mineral reserves” under the U.S. Rules are now “substantially similar” to the corresponding standards under NI 43-101. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that Ero reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms under the U.S. Rules are “substantially similar” to the standards under NI 43-101 and CIM Standards, there are differences in the definitions under the U.S. Rules and CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that Ero may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had Ero prepared the reserve or resource estimates under the standards adopted under the U.S. Rules.