VANCOUVER, British Columbia, Sept. 15, 2025 (GLOBE NEWSWIRE) — King Copper Discovery Corp. (“King Copper”, or the “Company”; KCP-TSXV, TBXXF-OTCQB, 3RI-FSE) is pleased to announce that it has closed its previously announced non-brokered private placement offering (the “Financing”) for aggregate gross proceeds of approximately $15 million from the issuance of 65,217,390 common shares in the capital of the Company (the “Shares”) at a price of $0.23 per Share.

The net proceeds of the Financing will be used to advance exploration, including diamond drilling of the Company’s flagship Colquemayo copper-gold project and for working capital purposes.

A strategic investor (the “Investor”) participated in the Financing and holds approximately 9.99% ownership interest in King Copper on an undiluted basis. King Copper and the Investor entered into an investor rights agreement whereby the Investor was granted certain rights, subject to the Investor maintaining certain ownership thresholds in the Company, including (i) the right to participate in future equity financings and top-up its holdings in the event of dilutive issuances in order to maintain its pro rata ownership in the Company at the time of such financing or to acquire up to a 9.99% ownership interest, on a partially‐diluted basis, in the Company; and (ii) the right (which the Investor has no present intention of exercising) to nominate one person (and in the case of an increase in the size of the board of directors to eight or more directors, two persons) to the board of directors of King Copper.

The subscribers in the Financing included a director as well as one corporate subscriber controlled by an officer of the Company (collectively, the “Insiders”), who subscribed for an aggregate of 300,000 Shares for aggregate gross proceeds of $69,000 to the Company. The issuance of Shares to the Insiders constitute “related party transactions” as defined in Multilateral Instrument 61-101 – Protection of Minority Securityholders in Special Transactions (“MI 61-101”). The Company is relying on the exemption from valuation requirement and minority approval pursuant to subsection 5.5(a) and 5.7(1)(a) of MI 61-101, respectively, for the Insiders participation in the Financing, as the value of the Shares subscribed for do not represent more than 25% of the Company’s market capitalization, as determined in accordance with MI 61-101.

All securities issued in connection with closing of the Financing are subject to a statutory hold period of four months plus a day from the date of issuance in accordance with applicable securities legislation, expiring on January 16, 2026.

In connection with closing of the Financing, the Company paid $111,141 to certain eligible arm’s-length finders. The private placement is subject to the final approval of the TSX Venture Exchange.

Eventus Capital Corp. acted as an advisor to King Copper.

On Behalf of the Company,

Jonathan Richards, Chief Executive Officer

Website: kingcopperdiscovery.com

Address: #1507 – 1030 West Georgia St, Vancouver, BC V6E 3M5.

For Investor Relations enquiries, please contact +1 604 229 5208 or via [email protected].

Statements

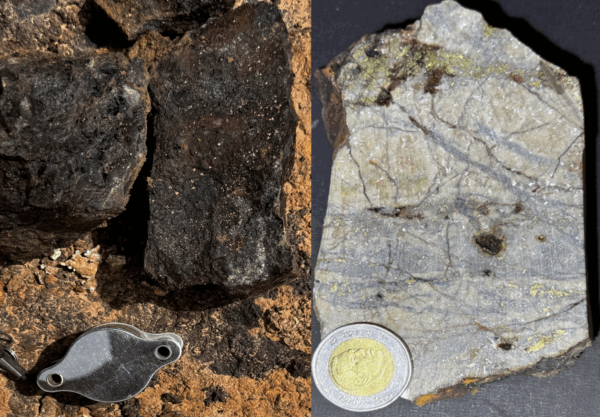

About King Copper Discovery Corp and Our Projects: King Copper is a TSXV-listed exploration company focused on the Colquemayo gold-copper project in South America. The Company is led by a team responsible for multiple gold-copper-silver discoveries.

Forward Looking Statement: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements, including the expected use of proceeds from the Financing.

Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the receipt of regulatory approvals, market prices, continued availability of capital and financing, and general economic, market or business conditions, as well as legal, social, and economic conditions in Argentina and Peru, where the Company’s mineral exploration properties are located. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release or has in any way approved or disapproved of the contents of this press release.