NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR RELEASE PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

TORONTO, Nov. 25, 2024 (GLOBE NEWSWIRE) — PTX Metals Inc. (CSE: PTX) (OTCQB: PANXF, Frankfurt: 9PX) (“PTX” or the “Company”), a mineral exploration company focused on high-quality Cu-Ni-PGE-Au and gold projects in northern Ontario, is pleased to announce that due to increased demand it proposes to increase the size of its previously announced private placement financing (the “Private Placement”) from $2,250,000 to up to $3,000,000.

The Private Placement consists of a (i) non-flow through component, consisting of up to 8.0 million units of the Company (“Units“) at a price of $0.125 per Unit for aggregate gross proceeds of up to $1.0 million (previously up to $750,000) (the “Non-FT Offering”), and (ii) a flow-through component (the “FT Offering“), whereby the Company will now issue up to 14,285,714 (previously up to 10,700,000) flow-through common shares in the capital of the Company (“FT Shares“), at a price of $0.14 cents per FT Share, for aggregate gross proceeds of up to $2,000,000 (previously up to $1,500,000). Each FT Share will qualify as a “flow-through share” as defined in subsection 66(15) of the Income Tax Act (Canada).

It is anticipated that the Private Placement will close in multiple tranches, with the first tranche expected to close on or about December 3, 2024. The Private Placement remains subject to various closing conditions, including the approval of the Canadian Securities Exchange (the “CSE“). The gross proceeds of the FT Offering will be used by the Company to incur eligible “Canadian exploration expenses” that will qualify as “flow-through critical mineral mining expenditures” as such terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures“) related to the Company’s mineral projects including the W2 Cu Ni PGE Au project on or before December 31, 2025. All Qualifying Expenditures will be renounced in favour of the subscribers effective December 31, 2024. The net proceeds from the sale of the Non-FT Offering will be used by the Company to finance exploration and development activities and for working capital and general corporate purposes.

Upon closing the Private Placement, the Company will announce exploration plans for its W2 Cu Ni PGE and South Timmins Gold Projects.

For more detailed information about the Private Placement, please refer to the Company’s press release on November 19, 2024.

About PTX Metals Inc.:

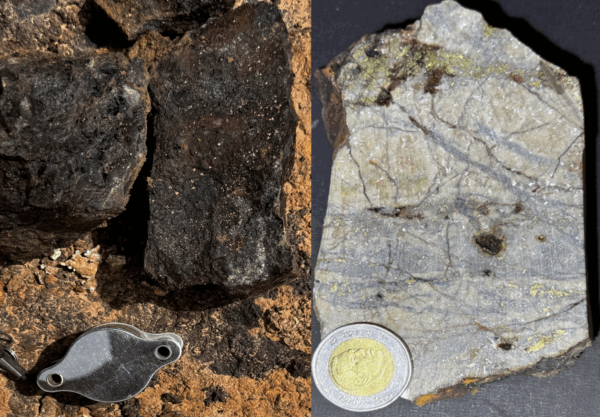

PTX is a mineral exploration company focused on high-quality critical minerals projects, including two flagship projects situated in northern Ontario, renowned as a world-class mining jurisdiction for its abundance of mineral resources and investment opportunities. Our corporate objective is to advance the exploration programs towards proving the potential of each asset, which includes the W2 Cu-Ni-PGE and gold Project and South Timmins Gold Joint Venture Project.

PTX’s portfolio of assets offers investors exposure to some of the world’s most valuable metals including gold, as well as essential critical minerals for the clean energy transition: copper, nickel, PGE, uranium and rare metals. PTX’s portfolio of assets was strategically acquired for their geologically favorable attributes, and proximity to established mining companies. PTX’s mineral exploration programs are designed by a team of expert geologists with extensive career knowledge gained from their tenure working for global mining companies in northern Ontario and around the world.

PTX is based in Toronto, Canada, with a primary listing on the CSE under the symbol PTX. The Company is also listed in Frankfurt under the symbol 9PF and on the OTCQB in the United States as PANXF.

For additional information on PTX, please visit the Company’s website at https://ptxmetals.com/.

For further information, please contact:

Greg Ferron, President and Chief Executive Officer

Phone: +1 (416) 270-5042

Email: [email protected]

Forward-Looking Information

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information, including statements regarding the ability of the Company to satisfy regulatory, stock exchange and commercial closing conditions of the Private Placement, and the potential development of mineral resources and mineral reserves which may or may not occur. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and general economic and political conditions. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary approvals, including governmental and regulatory approvals will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, other than as required by applicable laws. For more information on the risks, uncertainties and assumptions that could cause our actual results to differ from current expectations, please refer to the Company’s public filings available under the Company’s profile at www.sedarplus.ca.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.